Presented By Devin Sanford Homes

Uncle Sam collected excise tax on five sales as they closed escrow during April, one less than last year. Four of the five brought full price or better in about 4 days with one closing under the asking price. From the start of 2022 through April, all combined closings averaged 109.27% of the original asking. April finished at 106.3%.

Five Closings for April

| Model | NWMLS Number | Original Asking Questions | Dollars per Square Foot | Final Sale Price | Days on Market | % of Asking Price |

| Chelan | 1896086 | $798,000 | $653.85 | $850,000 | 5 | 106.52% |

| Orchard | 1904171 | $889,000 | $607.64 | $875,000 | 7 | 98.43% |

| Vancouver | 1908171 | $1,388,000 | $717.95 | $1,400,000 | 5 | 100.86% |

| Cedar | 1914367 | $1,498,000 | $715.84 | $1,650,000 | 0 | 110.15% |

| Maryhill | 1891373 | $1,575,000 | $540.06 | $1,820,000 | 4 | 115.56% |

There were nine closing for May, down 25% year-over-year. Seven of these agreements were simmering in escrow at the end of April. Last month, I suggested we’ll see the first two-million-dollar sale in Trilogy soon and now we have it. The all-time champion price for any TRR home sale in its history, is close to the Cascade Club and rests on the coveted 17th Fairway. The Monticello plan was not listed for sale on the Northwest Multiple Listing Service.

Nine Sales Rain Down During May

| Model | NWMLS Number | Original Asking Questions | Dollars per Square Foot | Final Sale Price | Days on Market | % of Asking Price |

| Orchard | 1911849 | $789,000 | $576.92 | $825,000 | 5 | 104.56% |

| Discovery | 1914135 | $835,000 | $629.63 | $875,000 | 3 | 101.8% |

| Washington | 1909807 | $875,000 | $478.35 | $895,000 | 10 | 102.29% |

| Discovery | 1923735 | $895,000 | $681.32 | $930,000 | 5 | 103.91% |

| Vancouver | 1911052 | $1,195,000 | $540.06 | $1,208,000 | 4 | 101.09% |

| Bainbridge | 1914617 | $1,295,000 | $692.51 | $1,295,000 | 5 | 100% |

| Maryhill | 1911446 | $1,895,000 | $563.99 | $1,895,000 | 7 | 100% |

| Monticello | 1930061 | $2,000,000 | $742.12 | $2,000,000 | 0 | 100% |

At the time of drafting this report, seven “pending” files are being processed through the system. Their average original list price was slightly under $1,150,000, 1,826 Sq. Ft., $609.18 per Sq. Ft. and 13 days on market. The days on market are skewed by two 1%er listings lagging comparatively into escrow 19 and 39 days, respectively. The first had a $145,000 price drop and the latter a $45,000 price drop. We won’t know the final sales price until escrow closes. The other five sales averaged six days among them, a day longer than the year-to-date average of five. The Orchard plan reached mutual acceptance subject to inspection, and we have not seen that in some time. This is an indication that 10 days was long enough to wait for an offer. I would expect to see more of this as inventory is growing rapidly.

Eight Pending Sales Project Positive June Figures

| Model | NWMLS Number | Original Asking Questions | Dollars per Square Foot | Asking Price when Sold | Days on Market |

| Chelan | 1910522 | $553,584 | $425.83 | $553,584 | 5 |

| Townsend | 1926911 | $850,000 | $634.33 | $850,000 | 6 |

| Orchard | 1934217 | $875,000 | $607.64 | $875,000 | 10 |

| Madison | 1931922 | $949,999 | $524.86 | $949,999 | 6 |

| Union | 1919803 | $1,295,000 | $761.59 | $1,150,000 | 19 |

| Vancouver | 1910724 | $1,295,000 | $651.04 | $1,250,000 | 39 |

| Alder | 1935140 | $1,498,888 | $573.19 | $1,498,888 | 8 |

| Hemlock | 1923103 | $1,588,000 | $693.45 | $1,588,000 | 5 |

I had stopped sharing active listings for a bit. It became nebulous when they were coming off the market faster than we could say Rumpelstiltskin. We would see one to three houses come available and they were gone in a day or two: sometimes within hours. The tides are changing. There are nine active homes as I tickle my keyboard. They average 17 days on market, the longest year to date but, also skewed by two 1%er listings of 48 and 21 days at month end. The first has had a $150,000 price drop and the second a $60,000 price drop. Remove those contingencies and the remaining four average 8.25 days on market.

Active Listings Earn Their Way Back to the Report

| Model | NWMLS Number | Original Asking Questions | Asking Price when Sold | Days on Market |

| Whidbey | 1915901 | $1,299,000 | $1,149,000 | 48 |

| Vancouver | 1929780 | $1,250,000 | $1,190,000 | 21 |

| Bainbridge | 1940195 | $1,198,000 | $1,198,000 | 6 |

| Bainbridge | 1942090 | $1,225,000 | $1,225,000 | 0 |

| Hemlock | 1923213 | $1,499,000 | $1,499,000 | 20 |

| Hemlock | 1939674 | $1,775,000 | $1,775,000 | 7 |

Figures and statuses are as of May 31st, 2022, for month over month comparisons. The number of homes for sale will likely change by the time this market report has processed to you.

By the end of May, Trilogy has had 27 Sales. With each having a Selling Broker and a Listing Broker, which makes for 54 sides and commissions. 38 Different Listing or Selling Brokers received those dividends: some having more than one. There have been seven homes either sell for less than the asking price or have a price reduction by May’s end. Six of the seven were listed by the same dynamic duo boasting how much their 1% fee will save you. The Discovery alone resulted in a sale of 4% below the original asking price or 6% below the average May closings; where’s the savings. The minor $14K drop on the Orchard was the only other Listing Broker to reduce a price this year. In fairness, they have had sales above the asking price, as well. It’s inevitable in a short supply, high demand market like we’ve experienced. 100% of the homes sold full price or better were listed by conventional fee brokers, and it speaks volumes. You can choose a conventional Broker or roll the dice. With 18 Years of focus on Trilogy and hundreds of sales, I’ll get it done for you. Call me and let’s chat.

Seven Price Concessions Year to Date …

| Model | NWMLS Number | Original Asking Questions | Reduced Asking Price | Days on Market | Square Footage |

| Whidbey | 1915901 | $1,299,000 | $1,149,000 | 58 | 1,670 |

| Vancouver | 1929780 | $1,250,000 | $1,190,000 | 31 | 1,910 |

| Union | 1919803 | $1,295,000 | $1,150,000 | 19 | 1,510 |

| Vancouver | 1910724 | $1,295,000 | $1,250,000 | 39 | 1,920 |

| Discovery | 1891873 | $875,000 | $825,000 | 9 | 1,350 |

| Union | 1895629 | $925,000 | $900,000 | 12 | 1,510 |

| Orchard | 1904171 | $875,000 | $825,000 | 7 | 1,440 |

Figures and statuses are as of June 11th, 2022. Results of sales prices cannot be confirmed until the home has closed escrow and statuses will change along the way

Elephant Observations and Prognostications…

The market is leveling out a bit and Sellers need to keep their expectations more realistic. I spoke with Engy Goldrick, a Senior Account Executive with WFG National Title Company who said, “Inventory is growing fast, there’s more to choose from and Buyers are being more selective. Homes are not selling the next day and we’re not seeing buyers releasing the earnest money up front as much.” The average days on market county wide is 25; a year ago it was 16. We’re seeing a few agreements subject to inspections and a contingent deal here and there. That wasn’t happening even a few weeks ago. As inventory grows and mortgage rates rise, some sellers are growing concerned that they could miss the peak of the market. Sellers need to keep their heads and not get crazy with pricing. Over-pricing is the worst thing you can do. Those who do find their homes on the market longer and Brokers and Buyers begin to wonder what’s wrong with it.

King County is fortunate to have about a 2% unemployment rate which is close to half the national average. A strong job market is an indication our area will be among the last to reach a balanced market, where there’s a fair playing field between buyers and sellers. Just the same, normalcy or worse is coming. Inflation is rising at its fastest pace since 1981, groceries are up 12% and we all know the price of gas. Mike Larson, a member of the NWMLS Board of Directors and Managing Broker at Compass of Tacoma commented, “The days of multiple offers and waived inspections, at least in Pierce County, are behind us.”

Snohomish County, our sister to the South’s inventory is up over 135% from a year ago. King County is up about 10% and elevating.

The economy is scary right now and we’ve been spoiled with record appreciation. It might be a good thing in some respects that things are calming down. Sellers will be more willing to allow the buyers to have an inspection, get a loan or not have to give up their earnest money until the close of escrow. I like fair and candidly; I like it when things get tougher; my phone rings more and I get the opportunity to provide a service my clients can count on, every time. Give me a call.

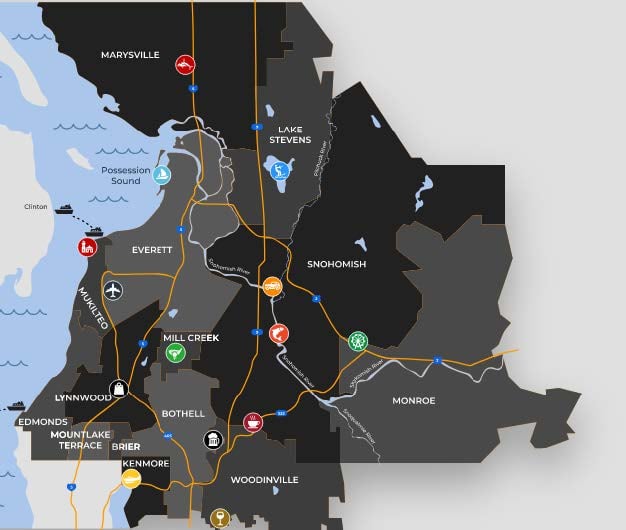

hometown and stomping grounds I’m born and raised in this area and love it!

It was mostly woods when I grew up in Lynnwood where we rode our sleds down 196th Street and my childhood home is now a Wells Fargo Bank, and our motorcycle riding grounds are the Alderwood Mall and an array of businesses. I grew up in the Edmonds School District and went swimming at Mukilteo and Edmonds beaches, lived in Woodinville and ran Track for Monroe then graduated from Inglemoor High School in Bothell. As an adult I’ve lived in Everett, Mill Creek, Monroe and on Lake Stevens. If you or someone you know need a Snohomish County Expert, I’d be delighted to hear from you.

“The truth has no defense against a fool determined to believe a lie.”

Mark Twain

I loved this recent article written by a very reputable Eastside Real Estate Veteran. She titled it, Do sellers really save money when using a ‘discount’ real estate broker? She hit the nail on the head. Buying listings by drastically under-cutting your peers’ professional fee isn’t respectful either. I think its selfish and very few brokers would go there. “It’s bad for the business”, a top Broker in Washington and one of the highest producing residential agents in the nation, said to me. Discount Brokers are a miniscule illustration of the 32,000 licensed Washington State real estate brokers. Yes, I’ll admit I’m upset that I spent 18 years building an honest business only to have it taken away and watched so many that I think I could have helped to a better outcome. I understand that reporting ill of others doesn’t help me and I’m certain it’s tiresome to read. I’ve thought about that many times but ask myself, “How else are Trilogy members going to know what’s going on?” I’ve been painstakingly creating these reports for 12 years so decided to exercise my 1st Amendment right to tell it like it is. First, I owe it to you and secondly, I owe it to myself. Jesus said, “The truth will set you free.” Hopefully, this truth will bear the fruit of your trust. I create the Sold, Active and Pending tables in these reports using data from the most reliable source I know; the Northwest Multiple Listing Service and the numbers don’t lie. Every sale records the Selling Broker and the Listing Broker. It is what it is, and I report what’s there. If it weren’t there, there’d be nothing to report. I hope you understand my pointing out who is responsible for the standout statistics and why. Behind the scenes some brokers and members are talking about it. What goes around, comes around and I’m sticking around.”

“When the going gets tough, the tough get going.”

Knute Rockne, Joseph Kennedy

The Pachyderm is going paperless until we weather this storm. It’s economics. Printing these reports and mailing them to 1,523 mailboxes is expensive and not currently viable. The hours at the keyboard are free. If you’d like to keep up until the tide turns, and it will, all you need to do is click the Trilogy tab at the home page of my website and enter your email address, or use the Google, or Facebook Tabs. That’s it and each time we send out a report, you’ll receive it in your email.

That’s a wrap thru May of 2022!

NOTICE: – If you’d like to join the hundreds of Trilogy Members who get these monthly reports DAYS SOONER via E-Newsletter,

join at www.DevinSanfordHomes.com under the “ABOUT” tab and we’d be happy to add you to our list of in the know recipients.

| Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | YTD | |

| $old | 2 | 2 | 9 | 5 | 9 | 27 | |||||||

| Pending | 2 | 3 | 2 | 7 | 7 | ||||||||

| Active | 0 | 1 | 2 | 6 | 6 | ||||||||

| $old D.O.M. | 4 | 5 | 6 | 4 | 4 | ||||||||

| Active D.O.M. | n/a | 5 | 1 | 9 | 17 |